Introduction

Consider managing a garden, where the growth rate is the sunlight and the profit margin is the soil. Both elements must work together harmoniously to cultivate healthy plants, much like the Rule of 40 fosters balance in SaaS companies.

In an industry where unicorns thrive on data and IPOs represent significant milestones, the Rule of 40 has become a key metric for assessing the health of SaaS companies. It offers a balanced approach, emphasizing the importance of achieving both rapid growth and sustainable profitability.

But before we dive headfirst into this numerical nirvana, let's peel back the layers of this seemingly simple rule and explore why it's become the holy grail for investors, founders, and armchair analysts alike.

What is the Rule of 40?

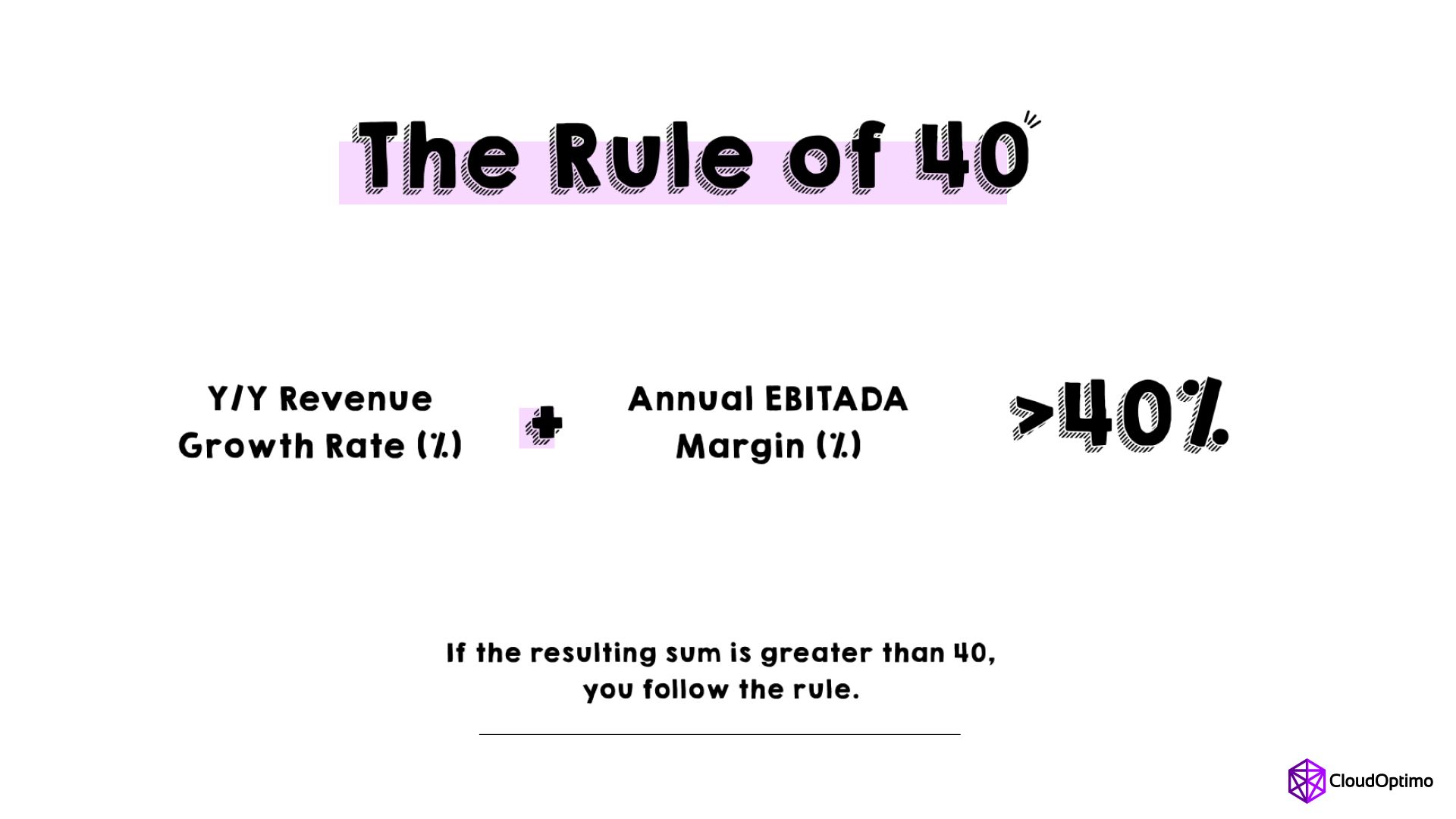

The Rule of 40 is fundamentally straightforward: a SaaS company's total growth rate combined with its profit margin should be 40% or higher. In mathematical terms:

Growth Rate + Profit Margin ≥ 40%

For example, if a SaaS company grows at 30% year-over-year and has a profit margin of 10%, it meets the Rule of 40 (30% + 10% = 40%). Similarly, a company growing at 50% with a -10% profit margin also satisfies the rule (50% + (-10%) = 40%).

This elegantly simple formula encapsulates a profound truth about SaaS businesses: there's a trade-off between growth and profitability, and the Rule of 40 helps quantify the optimal balance.

The Origins of the Rule of 40

Like many industry benchmarks, the Rule of 40 was not developed through peer-reviewed studies or intricate algorithms. Instead, it originated in the realms of venture capital and private equity, where investors required a straightforward method to evaluate SaaS companies.

The rule gained prominence in the mid-2010s, with Brad Feld, a prominent venture capitalist, often credited for popularizing it. However, its exact origins remain somewhat murky, much like the early days of many SaaS startups themselves.

Significance of Rule of 40

- Balanced Growth: The Rule of 40 encourages a balanced approach to growth. It recognizes that hypergrowth at the expense of profitability isn't sustainable in the long run, nor is modest growth with high profitability ideal for capturing market share.

- Investor Attractiveness: Companies that consistently meet or exceed the Rule of 40 tend to be more attractive to investors. The Rule of 40 is a quick way for VCs and public-market investors to gauge a company's financial health.

- Strategic Decision Making: The rule provides a framework for strategic decisions. Should a company invest more in growth or focus on improving profitability? The Rule of 40 helps guide these choices.

- Valuation Impact: SaaS companies that meet the Rule of 40 often command higher valuations. It's become a benchmark for premium multiples in both private and public markets.

- Long-term Sustainability: Companies adhering to the Rule of 40 are often better positioned for long-term success and weathering economic downturns by balancing growth and profitability.

Breaking Down the Components

- Growth Rate

Within the framework of the Rule of 40, growth rate generally denotes year-over-year revenue growth. This metric reflects a company's capacity to expand its customer base, boost revenue from current customers, and gain market share.

For early-stage startups, growth rates can be stratospheric – think 100% or more year-over-year. As companies mature, maintaining such high growth rates becomes challenging, which is where the profit component of the equation becomes increasingly important.

- Profit Margin

The profit component of the Rule of 40 is usually measured as EBITDA margin (Earnings Before Interest, Taxes, Depreciation, and Amortization) or free cash flow margin. These metrics provide insight into a company's operational efficiency and its ability to generate cash.

It's worth noting that many high-growth SaaS companies operate at a loss, especially in their early years. The Rule of 40 accommodates this reality by allowing negative profit margins to be offset by higher growth rates.

Applying the Rule of 40 Across Company Lifecycles

The Rule of 40 isn't a one-size-fits-all metric. Its application and interpretation can vary depending on a company's stage of growth:

- Early-stage Startups: For young SaaS companies, the focus is heavily tilted towards growth. It's not uncommon to see companies with 100%+ growth rates and significant negative profit margins. While they may satisfy the Rule of 40, the sustainability of this model is limited.

- Growth-stage Companies: As companies mature, balancing growth and profitability becomes crucial. A company might aim for 40-60% growth with margins approaching breakeven.

- Mature SaaS Companies: Established players might see growth rates slow to 20-30%, but this can be offset by healthy profit margins of 10-20% or more.

Limitations and Criticisms of the Rule of 40

While widely adopted, the Rule of 40 isn't without its critics:

- Oversimplification: Some argue that distilling a company's health to a single number overlooks other crucial factors like customer acquisition costs, churn rates, or market dynamics.

- Short-term Focus: The rule might encourage short-term thinking at the expense of long-term investments in R&D or market expansion.

- Industry Variations: The 40% benchmark might not be appropriate for all sub-sectors within SaaS. Enterprise-focused companies might have different optimal balances compared to SMB-focused ones.

- Growth Stage Bias: The rule can be less relevant for very early-stage companies or mature, slow-growth businesses.

- Manipulation Potential: Like any metric, there's potential for companies to game the system by manipulating either growth or profit numbers.

Strategies for Improving Your Rule of 40 Score

For SaaS leaders looking to boost their Rule of 40 performance, consider these strategies:

- Optimize Customer Acquisition: Improve marketing efficiency and sales processes to drive growth without proportionally increasing costs.

- Focus on Customer Retention: Reducing churn can significantly impact both growth and profitability.

- Implement Pricing Strategies: Regularly review and optimize pricing to capture more value from your product.

- Improve Operational Efficiency: Streamline processes, automate where possible, and optimize resource allocation.

- Expand Through Upselling and Cross-selling: Increasing revenue from current customers is usually more cost-effective than bringing in new clients.

- Invest in Product-led Growth: Develop features that encourage organic adoption and expansion within customer organizations.

- Balance R&D Spending: Invest in innovation, but be mindful of the impact on near-term profitability.

- Consider Geographic Expansion: Entering new markets can drive growth, but be cautious of the impact on profitability.

How Cloud Cost Optimization Supports the Rule of 40

Cloud cost optimization is instrumental for SaaS companies striving to meet the Rule of 40, which balances revenue growth with profitability.

1. Improving Profit Margins Optimizing cloud costs reduces operational expenses, enhancing overall profitability. Strategies include right-sizing resources, leveraging discounted pricing models like reserved and spot instances, and automating resource management for efficiency.

2. Enabling Efficient Growth By reallocating saved resources from optimized cloud costs into growth initiatives such as product development and marketing, SaaS companies can foster revenue growth while maintaining healthy profit margins. Cloud scalability facilitates rapid resource provisioning without significant upfront investments.

3. Enhancing Operational Efficiency Cloud cost optimization streamlines operations by identifying and eliminating inefficiencies. This boosts cost savings and profitability, while also improving time-to-market and scalability for enhanced customer experiences.

4. Aligning with Cloud FinOps Principles Adopting Cloud Financial Operations (FinOps) principles ensures cloud spending aligns with business goals like the Rule of 40. Continuous monitoring and optimization of cloud costs through FinOps practices enable data-driven decisions for cost-effective infrastructure.

In summary, effective cloud cost optimization empowers SaaS companies to achieve and sustain the Rule of 40. By optimizing expenses, fostering growth, enhancing efficiency, and aligning with financial best practices, companies can strike a balance between growth and profitability essential for long-term success in the competitive SaaS market.

Conclusion

The Rule of 40 has undoubtedly earned its place in the SaaS metrics hall of fame. It provides a quick, albeit imperfect, gauge of a company's financial health and potential. However, like any rule of thumb, it should be one tool in a larger toolbox of financial analysis and strategic planning.

As the SaaS landscape evolves, so do the benchmarks we use to evaluate success. But for now, the Rule of 40 remains a valuable North Star for SaaS companies navigating the complex waters of growth and profitability.

Remember, in the end, the most crucial rule is building a product that customers love and a business that can sustainably deliver value over the long term. If you can do that while hitting that magical 40% mark, you might just find yourself with a ticket to the SaaS hall of fame – and a pleased vending machine of investors ready to fuel your journey.